Posted by Apex Home Loans ● January 19, 2022

The Best Way to Approach Rising Mortgage Rates

At the end of November 2021, the average 30-year fixed mortgage rate from Freddie Mac rose above 3.1%. Unfortunately, experts see this trend continuing for the near future.

“The 30-year fixed-rate mortgage was 2.9% in the third quarter of 2021. We forecast mortgage rates to increase slightly through the remainder of the year and reach 3.0%, rising to 3.5% for the full year 2022”, says Freddie Mac.

Are you wondering if you should purchase a home? Below we have listed a few things to keep in mind as mortgage rates continue to rise.

Waiting Could Cost You

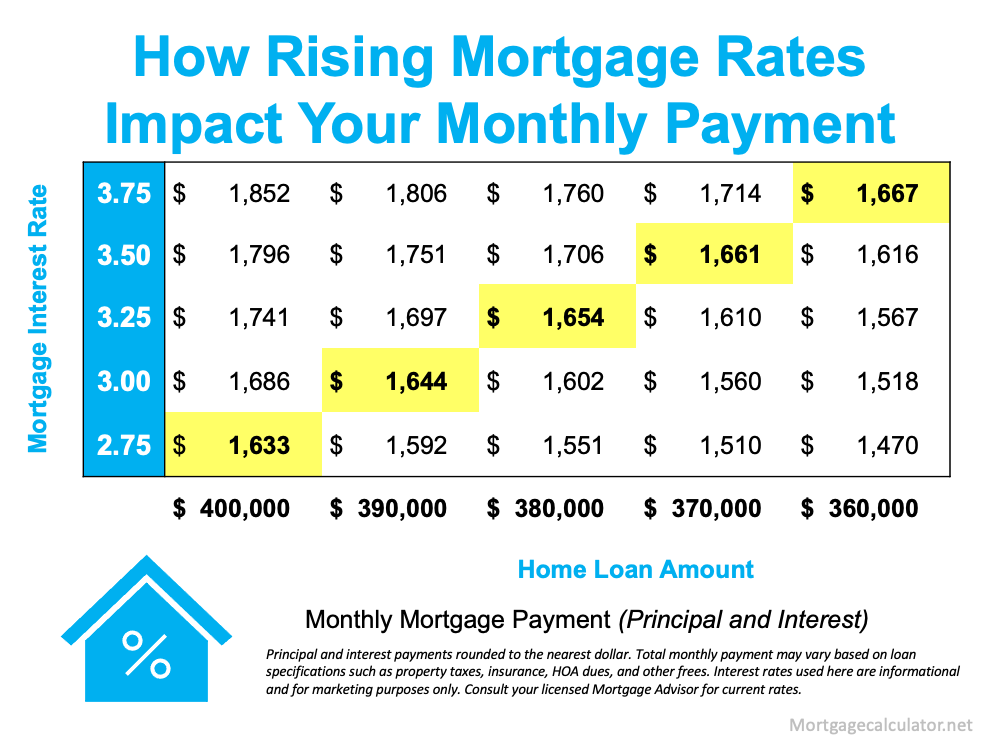

Waiting to buy could end up costing you more money as mortgage rates are slowly creeping up. Even if they only rise .25%, your monthly mortgage payment will also increase, which in turn decreases how much home you can afford. Check out the graph below to see how mortgage rates factor into your monthly payment.

If you’ve been trying to time the market, you’ve likely already seen your purchase power dwindle a bit. With experts predicting a continuous rise in interest rates, you may want to consider starting your homebuying journey sooner rather than later.

Planning Is Key In the Homebuying Process

With rates on the rise, it’s more important than ever to come up with a solid homebuying plan, especially considering the current market. Starting your homebuying journey by getting pre-approved is key to having a solid strategy.

It is in your best interest to start your homebuying journey by getting pre-approved so you know exactly how much you can afford. This will show the seller that you are a serious buyer once they see your offer since they know you can afford what you are offering. Additionally, a pre-approval should identify any potential issues before you make an offer. Once you get pre-approved, connect with a trusted real estate agent. A real estate agent can help you modify your search to the amount you can afford, and act in a timely matter when it is time to make an offer on the home you’ve been eyeing.

Bottom Line

If you are in the market to buy a home, now is the time to do so before rates rise even more. If you need a realtor to help you find your dream home, we would be happy to recommend a few local and trusted options. Connect with our team today to get started on your homebuying journey!

Topics: Mortgages, Market Timing, First Time Homebuyer, Homebuyer Tips, Mortgage Rates, 30-year Fixed Rate Mortgage, Housing Market, Buying a Home, Market Outlook, Preapproval, Homebuyer, monthly payment, Buying Home During COVID-19, Mortgage for Millennials, Pandemic Home Buying, rising mortgage rates